The Energy Consulting Group

Management consultants for upstream oil and gas producers and service companies

|

Saudi Arabia: Ghawar-The World's Largest Oilfield; Saudi Arabia Oil and Gas Industry (Aramco) |

USA Natural Gas Supply/Demand Fundamentals (what it means for North American gas prices) |

| Syrian Oil and Gas |

|

Table of Contents

Links to Website Information

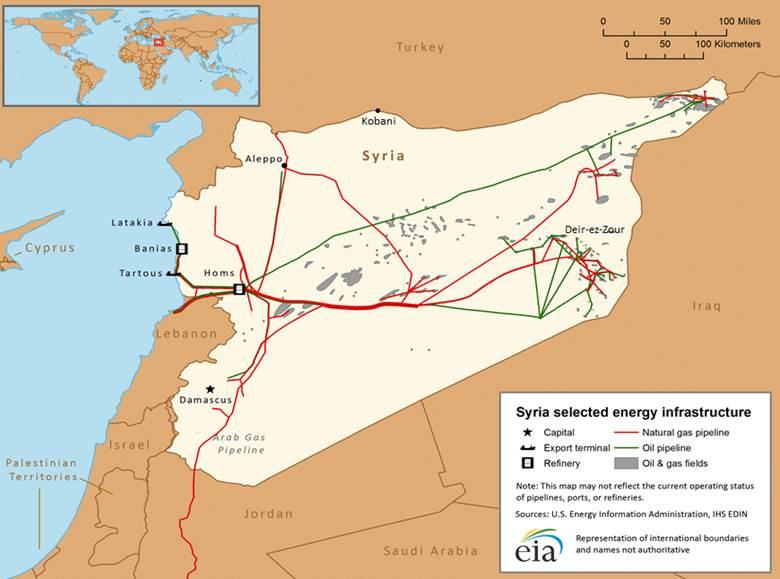

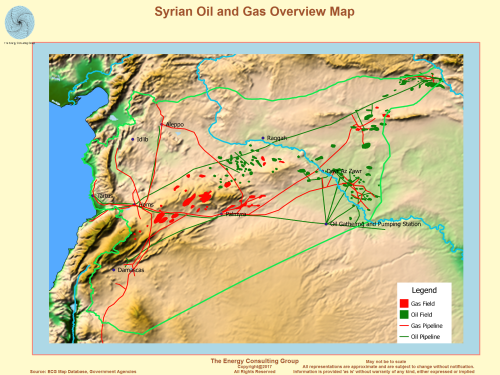

Syrian Oil and Gas Overview Map

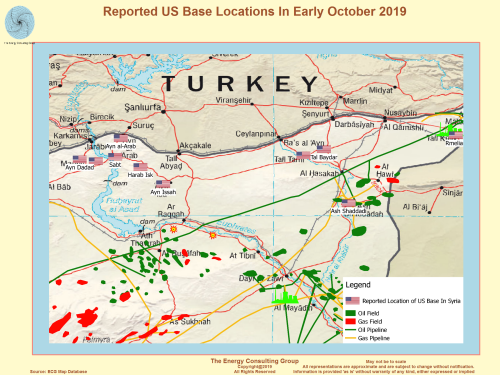

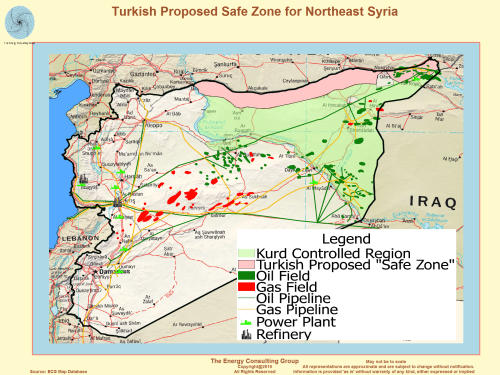

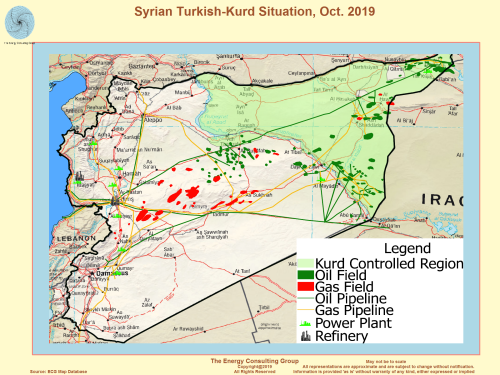

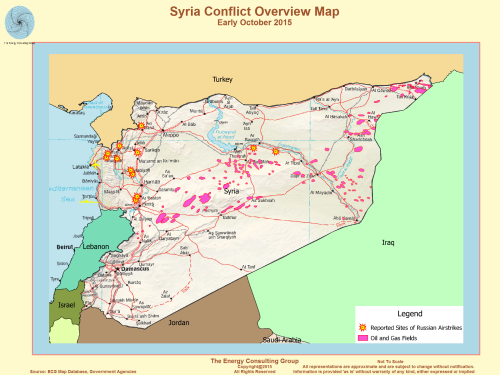

Turkish-Kurdish Situation Map in Northeastern Syria-October 2019 Video Showing The Post Apocalyptic Hell That Has Befallen the Syrian Oil and Gas Industry Battle for the Deir el-Zour Oil and Gas Fields Interactive 3D Elevation/Road Map of Syria Map Showing Potential Oil Capacity of Selected Syrian Oil Fields Iranian-Yemen Missile Attacks on Saudi Arabia Recent News about the Syrian Oil and Gas Industry History of the Syrian Oil and Gas Industry Historical Oil and Gas Production Levels of Syria EIA Syria Overview Saudi Arabia Oil aand Gas Overview Reported US Base Locations In Early October 2019 Note: Most of the bases were along the M4 north Syrian highway, which is now set to be roughly the southern extent of Turkey's planned safe zone.  For Higher Resolution, Click Image Turkish Proposed Safe Zone for Northeast Syria  For Higher Resolution, Click Image Video of British airplanes bombing Syrian oil fields (euronews) Video from AFP showing Kurds successfully operating a large oilfield in NE Syria Image of Kurds Manually Operating Oil Field Equipment in Northeastern Syria  Image of Kurds Operating a Large Oil Field in Northeastern Syria  Video of Turkish "tanks" firing on Kurdish positions prior to the cease fire. |

Syrian Conflict: Clash Between Iran

and Israel Nov. 20 2019 ========================= 1) Israel responded to the 4 missiles launched on Nov. 19th from Syria towards the Golan Heights with overnight raids against Iranian targets in Syria killing 23, including 16 Iranians.These back and forth attacks suggest an escalation of the conflict between Israel and Iran. In turn, this raises questions on whether Israel will start directly attacking high value targets in Iran, including within its oil industry. Map of Potential Targets in Iran The US withdraws from Syria: Latest Reports and Videos Oct. 30 2019 ========================= 1) At a news conference on Monday, October 28, US Defense Secretary stated in response to a question that, “US troops will remain positioned in this strategic area to deny ISIS (Daesh) access those vital resources. And we will respond with overwhelming military force against any group that threatens the safety of our forces there,” he confirmed that this exclusion also includes Syrian or Russian forces. Oct. 29 2019 ========================= 1) The Syrian oil industry is likely going to need considerable investment to repair the damage visited upon it during the long years of civil war. As a reminder, the forces arayed against ISIS specifically targeted much of the Syrian oil and gas industry because the Islamic militants were using oil produced from the fields to finance the Islamic state and the various acts of violence in the region and in the west. Video of British planes bombing a Syrian oil field.What President Trump appears to be saying is that because these repair costs will not be bourne by the US tax payer, the Syrians/Kurds need companies with deep pockets to pay for the repairs. Natural candidates for such are oil companies, which have both the expertise and the capital to repair the fields. 2) Israel is reminding the industry that the proliferation of precision guided munitions, such as those that were used in the Abqaiq and Khurias attacks in September, continue to improve in accuracy and grow in power. Specifically, Israel is pointing towards Iran, and the growing sophistication of its missile arsenal and the increasing threat it represents. However, what is frequently unsaid in such commentary is the vulnerability of Iran itself to the same type of weapons, as is shown by this map, which presents the potential targets in Iran that might be vulnerable to such weapons or retaliation if the use of such weapons were tied back to it. Oct. 28 2019 ========================= 1) Trump indicated at his press conference announcing the successful operation to eliminate al-Baghdadi that he wanted US oil companies to manage the residual Syrian oil and gas fields. Specifically, he stated "What I intend to do, perhaps, is make a deal with an ExxonMobil or one of our great companies to go in there and do it properly...and spread out the wealth," he said. Though ExxonMobil was specifically mentioned, if such an arrangement were executed it would probably be performed by a service sector firm, especially one of the mid-size firms, working with Kurdish authorities. Who knows, perhaps they could be enticed by being offered the Syrian frack concession on a long term basis? This is a link to graphs presenting Syria's historical oil and gas production numbers. 2) Per the VOA, "Russia's defense ministry on Saturday attacked U.S. plans to maintain and boost the American military presence in eastern Syria as "international state banditry" motivated by a desire to protect oil smugglers and not by real security concerns." Link to full article 3) Kurds have a long history operating Syrian oil and gas fields in NE Syria. As illustrated in this video, Kurd have a long history of operating Oct. 27 2019 ========================= 1) ISIS leader, Abu Bakr al-Baghdadi, has reportedly been killed by US special forces (see location map). The US troops raided a compound in Barisha in the Syrian province of Idlib. (Link to detail map showing location of the operation using the type of tactical map potentially used to guide the raid. Click on the blue sphere for links to articles and videos about the raid.) 2) Per earlier reporting, not all US troops will exit Syria. Some will remain as an insurance policy against Syrian oil and gas fields from being reacquired by ISIS. To that end, US troops (as shown in this video) moved through Qamishli, Syris yesterday on the way to the oil and gas fields of southern Syria. Oct. 26 2019 ========================= 1) In news related to ongoing events in Syria, 1000 ISIS fighters recently surrendered to Kurdish Perhmerga figthters near Kirkuk. The Kurds are resisting demands from the Iraqi authorities to hand over the militants. Video of US troops reentering Syria enroute to oil and gas fields to the south. More details are presented in this video. Oct. 25 2019 ========================= 1) Reports indicate that the US will leave about 500 troops in Syria to keep ISIS from reacquiring the oil and gas fields in the eastern third of the country. The deployment will reportedly include tanks. (see map for approximate location of the oil and gas fields, pipelines and our understanding of the location of the US guardian bases.) Here is a link to a second map with the locations and our estimates of the prewar productive capacity of the main Syrian oil fields. 2) Reports indicateTurkish led forces attacked Syrian forces at the town of Tal Tamr in northeastern Syria. Several Syrian soldiers were reportedly killed. Given that Turkey's Syrian allies consist of a mix of Islamisists and anti-Syrian government rebels, who have an inherent animosity towards the Syrians/Russians, more such conflicts are not only possible, but likely. Will such conflicts lead to a major escalation of the conflict between Syrian and Turkish forces? Probably not in the near term, but it does illustrate how inherently unstable the situation is, and more problematic for the Syrians is that the safe zone will not exist without the continued, long term occupation by Turkish troops. No country can tolerate such an occupation, especially by a power that has publically called for the elimination of the government. So, the question becomes when will the Syrians force out the Turks, and how violent will the process be? 3) Video showing Turkish led forces entering Ras Al-Ain. Oct. 24 2019 ========================= 1) Russians are demanding that US forces vacate Al Tanf on the Syrian-Iraqi border (see map). This clearly signals that the Russians will soom be demanding that the US vacate other positions that are overseeing oil and gas fields in southern Syrian, including involved in the battle between US and Russian forces in the Deir el-Zour region. In that battle, the US killed over 200 Russians (see for description), and now that US forces are backpeddling out of the region, the Russians are likely to assert their newly gained supremacy. Oct. 23 2019 ========================= 1) Turkey is essentially declaring victory and has indicated that it will no longer pursue offensive military operations in northeast Syria.(see map) As a result, Turkey is reportedly rethinking its plan to establish 12 military bases inside northeasten Turkey. 2) Per an agreement recently reached in Sochi between Putin and Erdogan, Russia has informed the YPG and its fighters that they must pull back at least 20 kilometers from the Turkey-Syrian border or face military action. 3) The US relayed to Ankara that Syrian Kurdish forces have evacuated the so-called "safe" zone. However, this appears to now be limited to the area between Tal Abad and Ras al-Ain and bounded by the M4 on its southern edge (see map). This is a considerably smaller area than originally indicated by Ergodan when the Turkish invasion started. 4) Given the developments listed in the previous three bullet points, the axis of conflict is now shifting from Kurd vs Turkey to Syria (Assad) vs Turkey (Erdogan). The Syrian government under Assad views the Turkish incurrsion to be an invasion, and now wants to expel the occupiers from northeastern Syria. This obviously sets up a heightened tension between the two countries, especially as the Turks begin to shift millions of Syrian refugees from within its borders to the part of Syria it has newly conquered. 5) Merkel is proposing that the "safe zone" just created in northeastern Syria be administered by amongst others, the German military. The Syrians and Turks may both have something to say about that. Oct. 22, 2019 ========================= 1) In a possible retaliation for the Abqaiq and Khurias attacks, a large fire has been reported at Iran's Abadan refinery. If so, this would be consistent with the analysis we performed and presented here and here showing possible retaliation targets. 2) As we suggested may be the case in previous commentary, it is now being reported (per this article) that the US is now signaling that at least some special forces personnel may stay in Syria to maintain control over the oil and gas fields. 3) Perhaps not surprisingly, Iraq is now suggesting that the US personnel pulling back from Syria are not welcome for longer than it takes for them to transit to somewhere else outside of Iraq. This unwelcoming stance appears related to apparent attacks by Israeli war planes on Iranian forces in Iraq, as well as on Iranian supported, Iraqi militia. Video of the Turkish airforce destroying what the they describe as a Kurdish ammunition loading area. 4) Iran is now suggesting that Turkish bases in the so called Syrian "safe zone" will be unacceptable. We think it clear the Turks plan on establishing a permanent military presence in the zone, but what is not clear is what the Iranians may do in reponse to what they appear to view as a clear provocation. Oct. 21, 2019 =========================pan> 1) Reports are emerging that Turkey and Syria are directly discussing how best to proceed in northeastern Syria. As a reminder, as recently as 2017 Erdogan called Assad, Syria's head of government, a terroists that should be removed from power. That the two sides are actively discussing a way forward despite this deep seated animosity speaks to the desire of both parties to avoid a direct military confrontation, and have probably been encouraged to do so by the Russians. 2) Putin and Erdogan are reportedly meeting at Sochi to presumably discuss the limits to which Russia will agree regarding Turkey's invasion. Hard to see that the Russians will agree to either the geographic footprint or time frame that Turkey would like, but are they willing to fight the Turkish military if Erdogan insists? 3) Turkey states that Syrian protection of SDF and PDF forces constitutes an "act of war". 4) Kurdish fighters and civilians complete withdrawl from both the border city of Ras al-Ain and Sari Kani, which is near Tall Tamr, which is south of Ras al-Ain (see map). This withdrawl is consistent with the near term Turkish goal of clearing the area betweenTal Abyad and Ras al-Ayn, and which has been the focus of Turkish attention since the invasion began. 5) Syrian government gains access to the oil fields of Raqqa, Hama and Homs provinces. Spokesman state that the fields and associated infrastructure are completedly destroyed. This video shows the abysmal condition of at least some of the fields This link goes to a page with estimates of preconflict oil production capacities for several of the larger fields in this 3 province area. 6) Reports indicate that US troops continue to pull back from Syria and into Iraq. Oct. 18, 2019 ========================= Notwithstanding the cease fire agreement between Presidents Trump and Erdogan, there are reports of heavy fighting between Turkish/SNA and YDF/SPG forces in and around Ain Issa and Ras al-Ain(see map). One wonders when and if the cease fire will commence. Also, more reports are being posted regarding the possible use of phosphorus and napalm by Turkish forces against civilian Kurd populations. This link is to one such report. Oct. 17, 2019 =========================>In a potential game changer, Kurdish military spokesman are claiming that Turkish forces are deploying chemical weapons, napalm, and white phosphorus against civilian positions in Ras al-Ain, Syria (see map).&n. Though yet to be confirmed, such usage would be against civilized norms and likely result in further comdemnations and sanctions from the world community. Oct. 16 2019 =========================>In broad terms, the on-the-ground reality is shapping up to be roughly as follows: 1) Russian and Syrian troops have entered most areas in northeastern Syria previously overseen by US troops (see map). 2) This will lead to reintegration of the areas into Syria, maintaining Syria's territorial integrity, and, importantly, control of the main oil and gas producing regions in the country (see map). An important outcome of this reintegration is the prevention of the emergence of "Kurdistan", which no one other than the Kurds wants to happen. 3) The Turkish military may be allowed to control what it has already occupied, at least for as long as is takes to move between 2-3.5 million Syrian refugees currently in camps in Turkey into the Syrian territory Turkey controls. However, over the medium term these positions will likely prove untenable, and the Turkish occupiers will return to Turkey, leaving behind the resettled refugees. 4) The above will all be done without a major conflict breaking out between the players, and without ISIS remerging. The Kurds will obviously be disappointed, but in the world of realpolitik it is rare that all the parties get what they want, especially if a group, like the Kurds, is essentially "friendless except for the mountains." 5) As a side note, the Turkish military is claiming the operation into Syria east of the Euphrates, to be a success. We think it clear Turkish leadership had hopes of a broader operational footprint with more extensive engagement with the Kurds, however, these more expansive plans were apparently shortcircuited by the rapid deployment of the Syrian Army and Russian military personel across northeastern Syria over the past three days. Oct. 15, 2019. ========================= Reports indicate that the Russians are now in Manbij in either a role supporting the Syrian army or as the main guarantor of peace in that area. Either way, the operative outcome is to prevent Turkey from establishing itself in the town. It is also being reported that Russian jets are flying over areas where Turkish forces are prosecuting offensive operations agains the Kurds. This effectively prevents the Turks from using their planes to bomb the Kurds during said operations. The Syrian army is now reported to be back in Kobani and Raqqa, notorious as the capital of ISIS. US forces have repositioned into southern Syria as an insurance policy against the reemergence of ISIS. (all these changes are reflected in this latest map update) Oct. 14, 2019 ======================== Recent reports indicate that the Syrian army has taken control of the important road junctions on the M4 highway of Tall Tamr, and Ayn Isa. (see map). It is being further reported that the Syrian army and Turkish led irrelgulars are fighting in or near the important town of Manbij, for control of its important bridges that cross the Euphrates. (see map). O. Oct. 13, 2019 ========================= It is being reported that a deal has been reached between the Syrian Kurds and the Syrian government, such that the Syrian Army will enter the northeastern Syrian area controlled by the Kurds, starting with Manbij, Kobani, Qumishly, and Hasakah, to help resist the Turkish invasion. (see map) It It is further being reported that Syrian Army units are already being deployed into Manbij and Kobani. Oct. 12, 2019. ========================= A statement from the Turkish MOD dated Oct. 13, 2019 announced ,"As a result of the successful conduct of Operation Peace Spring, a depth of 30-35 km has been reached and M-4 highway (see map) has been taken under control." ========================= A statement from the Turkish MOD dated Oct. 12, 2019 announced ,"As part of the successful operations being conducted in the framework of Operation Peace Spring, the town of Rasulayn, located east of the Euphrates, has been brought under control." (see map) ========================= Video of Turkish troops securing the M4 highway in northern Syria near Tal Tamr, Oct. 13, 2019. Video of Turkish airforce destroying a truck with a twin machine gun mount, Oct. 12, 2019. Turkey Reportedly Attacks US Special Forces in Invasion, Oct. 11, 2019 Tens of Thousands Flee Homes; Turkish Invasion Encircles Tal Abyad and Ras Al-Ain Oct 11, 2019 Fierce On the Ground Fighting Being Reported Near Tal Abyad, Oct 10, 2019 Turkish Artillary Pounds Ras al-Ain; Civilians Flee the Attacks, Oct. 10, 2019 Erdogan is Threatening Europe With Millions of Syrian Refugees Oct 10, 2019 UN Security Council to Meet to Discuss Turkey's Invasion of Syria Oct 10, 2019 Turkish Missile Artillery Targets the Kurds At Jarabulus Oct 9, 2019 Turkish Troops Attack Kurds in northeastern Syria Oct 9, 2019 People Fleeing Attacks on Qamishli City Oct 9, 2019 Turkish Jets Over Tal Abyad Oct 9, 2019 |

|

Video of Russians entering Kobani on the Syrian-Turkish border. Video showing Russians reoccupying the Taqa aurbase in the Syria's Raqqa province. |

|

|

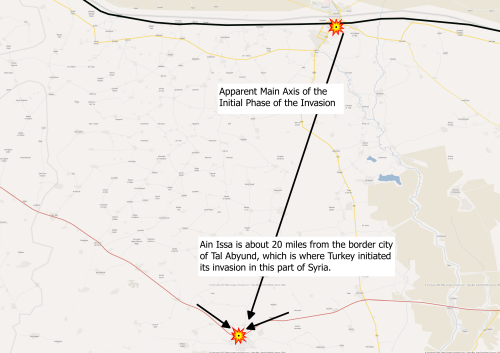

Main Assault Axis of the Turkish Invasion of Syria. Ain Issa appears to be a primary target, which would be consistent with its importance to the Kurds and with its location on the M4 highway.  Video showing Turkish forces fighting Kurds for the control of Ras al-Ain. |

|

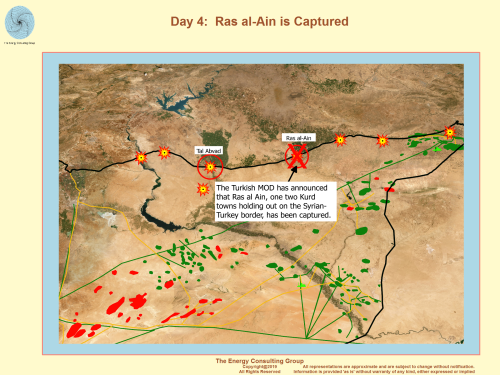

Invasion-Day 4: Turkish MOD reports

Ras al-Ain has been captured. For Higher Resolution, Click Image |

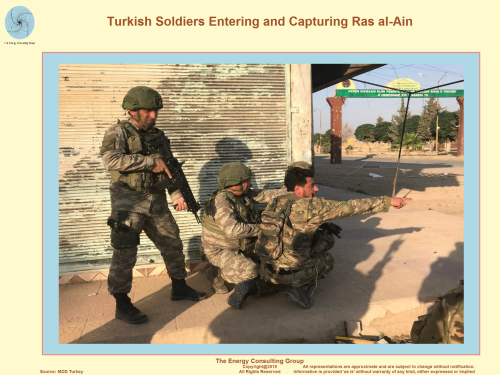

Turkish Soldiers Entering and Capturing Ras al-Ain, Oct. 12, 2019 For Higher Resolution, Click Image |

|

Turkish airforce F-16 taking off

at night with full afterburner. Video of Turkish airforce destroying what the Turkish military describes as a Kurdish ammunition loading area. |

Turkish Artillery Pounds Kurdish Towns in

Northeasthern Syria: October 9, 2019 For Higher Resolution, Click Image |

|

On Patrol With US Troops Near Tal Abyad, Oct 12, 2019 |

Syrian Turkish-Kurd Situation (October 2019) (This map shows not only the Kurd controlled region in northeastern Syria, but the oil and gas fields and infrastructure within that region.)  For Higher Resolution, Click Image |

Map With Updated Information on The Turkish

Incursion into Northeastern Syria name="Interactive 3D Elevation Map of Syria">

The following panel contains an interactive 3D

elevation map of most

of Syria with an overlay of oil and gas fields, pipelines, refining and

power generation and notable population

centers. It is intended to help

provide geographic context for the important oil and gas producing regions

in Syria relative to the Kurd's position and the Turkish incursion. (To use the interactive map,

rotate it using the left mouse button, zoom using the mouse wheel,

and control the viewing perspective (roam) using the right mouse button.

To access videos, photos, and stories related to the action around

each of the conflict points, place the mouse pointer in the center

of the explosion symbol and left click.Then, placing the mouse

pointer over one of the links, right click and open the media in

another tab.)

Link

to full screen version the rotatable, zoomable 3D oil and gas map of Syria shown

in the above panel insert.

Note: Town specific videos, images, and

stories can be called up by double clicking with the left button on the black center of the explosion symbol

and then left clicking again on one of the links. (Yes, we realize it is

different than how to access the same information in the embedded version of the

same map (above). We are working to resolve the inconsistency. Sorry for

any confusion, as we are still developing the technology.)

Video and images subject to availability.

Link to other examples of 3D, interactive mapping that we, the Energy Consulting Group, have done.

|

Video of background information on the situation between the Kurds and Turks

|

Video of US Forces Pulling Out of Positions in Northern Syria

(published by VOA by way of Reuters and ANHA) |

| Turkish planes have been reported attacking Kurdish positions

along the northeastern Syria/Turkey border. Link to video of twitter showing Turkish planes bombing Kurd supply lines. |

Kurds are armed with Javeline anti-armour weapons.

Will they use them against the Turks? |

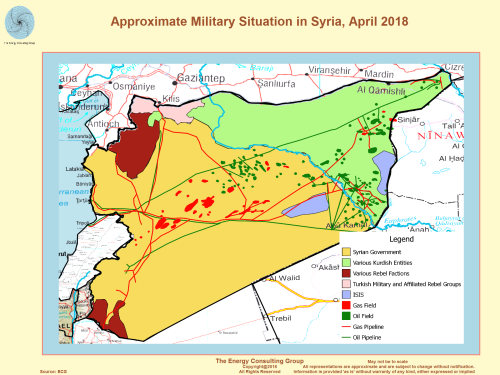

| This is a long running sage. In early 2018,

it was reported that President Trump had indicated he would

like to withdraw the US military from Syria when and if the

in-country situation improves. Based on what happened at Afrin,

it is only to be expected that as the US redeploys forces in eastern

Syrian, the Turks will take advantage of the situation to do the eastern

Kurds what they did to those in Afrin. Video, purportedly released by the Turkish airforce by way of CGTN, supposedly showing an attack on Kurdish positions during the reduction of the Kurdish pocket around Afrin in early 2018. The question naturally arises as to what will happen to the Syrian oil and gas fields in the eastern third of the country currently controlled by groups aligned with the US. With a drawdown in the US military presence in Syria, it is hard to imagine that the Syrian government, and possibly other governments, such as those in Turkey and Iraq, would not act to reduce Kurd presence and influence in the areas east of the Euphrates river, which also contain the most productive fields of the Syrian oil industry. One practical implication is that as the Syrian government seeks to reestablish control in the region, we may see a series of battles over oil and gas fields and support infrastructure, similar to the Battle for Deir el-Zour, referenced below. It is our view that while the US will likely withdraw its ground troops from Syria, it will use airpower to support its allies, potentially setting up direct military action against Syrian and allied armed forces, including those from Russia. |

Approximate Military Situation in Syria, April 2018 For Higher Resolution, Click Image |

|

Video of the post apocalyptic hell that

has befallen the Syrian oil and gas industry. It looks

straight out of an early Mad Max movie. |

Video of the start of

the Turkish invasion of the Kurd controlled area of northeast Syria as

reported by Bloomberg TV |

Battle for the Deir el-Zour Oil and Gas Fields

Battle for Deir el-Zour For Higher Resolution, Click Image |

Battle between US and Russian forces for Syrian oil and gas

fields in the Deir el-Zour province.

Per a Bloomberg article describing the battle, "More than

200 contract soldiers, mostly Russians fighting on behalf of

Syrian leader Bashar al-Assad," were killed. This news report indicates that Russian contractors earn up to a 25% ownership interest in each oil and gas field captured and returned to the Syrian government control. As the following pictures show, the oilfields that were the apparent target of the attack on Deir el-Zour, were all heavily damaged in the Syrian civil war. Omar Oil Field: Was this the Prize of the Battle of Deir el-Zour? Another Potential Prize of the Battle of Titans: Deir El-Zour Oil Field Sardhit: Another Potential Prize of the Battle of Deir el-Zour |

|

Syrian Conflict Overview Map Location Of Russian Airstrikes  For Higher Resolution, Click Image |

Syrian Oil and Gas Overview Map |

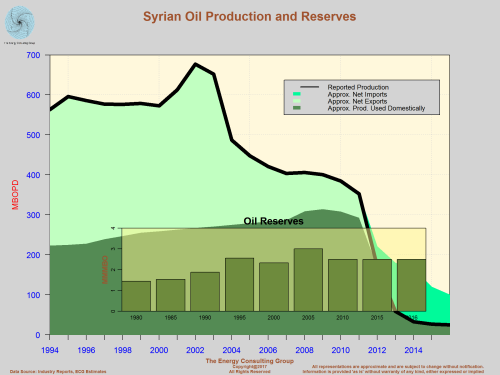

Syrian Oil Production and Reserves |

Syrian Natural Gas Production and Reserves |

If interested in a more complete listing of oil and gas infrastructure in Syria, including natural gas compressor stations, natural gas processing plants, refineries, oil pumping stations,etc., please contact us at insight@energy-cg.com./p>

The Energy Consulting Group home page

Interactive 3D Elevation Map of Syria

The following panel contains an interactive 3D elevation map of most

of Syria with an overlay of the road network and notable population

centers. It is intended to help

provide geographic context for the important oil and gas producing regions

in Syria. To use the interactive map, rotate it using the left mouse

button, zoom using the mouse wheel, and control the viewing perspective

using the right mouse button.

Link to page with estimate of field level oil production potential in Syria.

If you like this 3D map of Syria you might also appreciate these 3D maps as well (note: they work great on smart phones and tablets)

Link

to other examples of 3D, interactive mapping that we, the Energy Consulting

Group, have done.

A 3D map view of oil and gas exploration prospects in the Alaska National

Wildlife Refuge (ANWR)

|

|

|

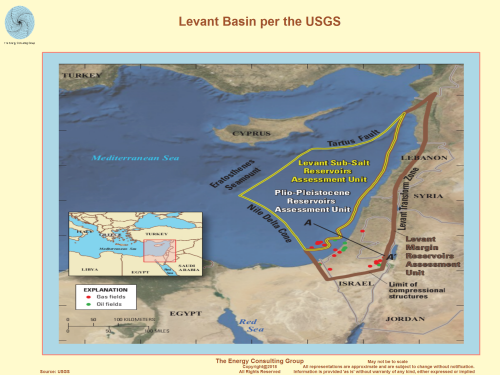

Levant Basin Province, located in the Eastern Mediterranean region, including parts of offshore Syria "An estimated 122 trillion cubic feet (tcf) (mean estimate) of undiscovered, technically recoverable natural gas are in the Levant Basin Province, located in the Eastern Mediterranean region. Technically recoverable resources are those producible using currently available technology and industry practices. This is the first U.S. Geological Survey assessment of this basin to identify potentially extractable resources. “The Levant Basin Province is comparable to some of the other large provinces around the world and its gas resources are bigger than anything we have assessed in the United States,” said USGS Energy Resources Program Coordinator Brenda Pierce. “This assessment furthers our understanding of the world’s energy potential, helping inform policy and decision makers in making decisions about future energy supplies.” Natural gas is used for a variety of purposes, primarily for electricity generation, industrial, residential, and commercial sectors. Worldwide consumption and production of natural gas was 110 tcf in 2008, according to the Energy Information Administration. The three largest consuming countries were the United States with 23 tcf, Russia with 17 tcf, and Iran with 4 tcf of natural gas per year in 2008. Russia’s West Siberian Basin is another large natural gas province with an estimated 643 tcf. The Middle East and North Africa region also has several large provinces, which include the Rub Al Khali Basin with 426 tcf, the Greater Ghawar Uplift with 227 tcf, and the Zagros Fold Belt with 212 tcf. Some natural gas accumulations in the United States include the Southwestern Wyoming Province with an estimated 85 tcf, the National Petroleum Reserve Alaska Province with 73 tcf, and the Appalachian Basin Province of the eastern United States and the Western Gulf Basin Province of Texas and Louisiana, each with 70 tcf. All of these estimates are mean estimates of undiscovered, technically recoverable gas resources." Source: USGS |

|

History of the Syrian Oil and Gas Industry History: Syria is located in the northwestern part of the Arabian Quay, the geographical location of Syria on the Mediterranean Sea and the similarities in the geological development with Iraq and Iran, where previously proved the presence of oil attracting researchers interested in oil resources to Syria

In the period 1923-1950:

The Iraqi Oil Company and then a Syrian oil company that dug 11 oil wells

In 1951-1956:

Oil wells and exploration were first drilled in the Karkuk field

In 1956:

Concordia signed an exploration contract and dug 12 wells where the oil flow from the Swedish field

In 1957:

The Syrian government conducted economic and technical cooperation with the Soviet Union

In 1958:

The General Oil Company, which oversees the oil industry, was established through cooperation with the Soviet side. During this period, the biological map of Syria In 1974: The Syrian Oil Company was established and undertook to undertake the exploration of gas and oil in all parts of Syria

In 1961-1975:

The Syrian Oil Company dug 485 exploratory wells and put a number of structures in production and a contract was signed with Rum Oil Company, which withdrew after drilling 7 wells

1975-1985:

A group of oil companies entered Syria and carried out geological and geophysical works on almost every Syria. 270 exploratory wells were drilled and the Syrian Oil Company recorded several explorations.

In the period 1986-1995:

This period was characterized by an increase in the exploratory activity of the Syrian Oil Company and the other companies with which the Syrian company signed contracts such as Shell, Elf Total, Marathon and Tolo, where the Syrian company discovered 15 gas and oil fields

1995-2006:

Another group of foreign companies signed contracts with the Syrian Oil Company

|

|

|

Recent News Recent Syrian Oil and Gas News: Tuesday, 13/3/2018 (A well of the continent / 3 / productivity 400 thousand m3 - well / 9 / productivity of 100 thousand m 3) in service. Within the framework of the plans to provide the national needs of crude oil, natural gas, oil derivatives and mineral resources, especially the fuel needed for the work of the power plants, the Minister of Oil and Mineral Resources Ali Ghanem inaugurated two new gas wells, the continent (3/9 / Half a million cubic meters of gas per day. In the context of the productive drilling operations in the safe and safe locations, including the fields north of Damascus, the efforts of national cadres working in the Ministry of Oil and Mineral Resources (Syrian Oil Company) resulted in the development of a well / 3 / gas in service at a depth of / 3572 / meter, To 400 thousand m 3, after the completion of drilling and testing on 4/3/2018, and immediately placed in the investment and was transferred to work on the new drilling site is the well / continent / 4 / new, which will start drilling soon. In a field in Homs, Ghanem inaugurated a well (9 /), which took the drilling and finishing operations in about seven months at a depth of 3670 m and was introduced in production after the completion of drilling on 3/3/2018 and estimated its productivity is about / 100 / thousand meters Cube of gas / day. Ghanem praised the exploration of the project to extend the link between the north of Damascus and the gas network by taking advantage of the materials and equipment in the oil and gas companies and thus reducing the expenses of implementing this project which will enter 1 million cubic meters of gas production during the month of 2018. The drilling rig on the well 10 / which will be started drilling soon, and is expected to take about 6 / months drilling. He also reviewed the new amendments made by national efforts and competencies on the plant in order to increase the capacity of the plant, which contributed to increase the plant capacity up to (2) million m3 / day. The Minister of Oil referred to the principle of self-reliance adopted by the cadres in their work during the follow-up meeting held in the Central Region Directorate in Al-Farqals - Homs province to follow up the implementation of a number of projects including: Rehabilitation of Wadi Obeid oil field and the collection and treatment plant, 248. 6 / million barrels of oil and the current production of about / 1400 / barrels per day and scheduled to increase to / 3000 / barrel / day by the end of the ninth month. As well as the rehabilitation of the heavy oil transport line between the pumping station of Akirishi and Homs according to the plan of the ambulance, which is scheduled to transfer about / 10 / thousand barrels / day after the completion of the estimated estimated by about 6 / months and thus dispense with the transfer of oil by tankers. The rehabilitation of gas wells in the north of the central region and plans to complete the construction of the gas plant were also followed. The project's production is expected to increase from 1.2 million cubic meters to about 3 million cubic meters per day by the end of this year. As well as the project north of Damascus (drilling and repair of wells, and construction of gas collection network). As well as the rehabilitation of the heavy oil transport line between the pumping station of Akirishi and Homs according to the plan of the ambulance, which is scheduled to transfer about / 10 / thousand barrels / day after the completion of the estimated estimated by about 6 / months and thus dispense with the transfer of oil by tankers. The rehabilitation of gas wells in the north of the central region and plans to complete the construction of the gas plant were also followed. The project's production is expected to increase from 1.2 million cubic meters to about 3 million cubic meters per day by the end of this year. As well as the project north of Damascus (drilling and repair of wells, and construction of gas collection network). As well as the rehabilitation of the heavy oil transport line between the pumping station of Akirishi and Homs according to the plan of the ambulance, which is scheduled to transfer about / 10 / thousand barrels / day after the completion of the estimated estimated by about 6 / months and thus dispense with the transfer of oil by tankers. The rehabilitation of gas wells in the north of the central region and plans to complete the construction of the gas plant were also followed. The project's production is expected to increase from 1.2 million cubic meters to about 3 million cubic meters per day by the end of this year. As well as the project north of Damascus (drilling and repair of wells, and construction of gas collection network.) |

EIA Syria Overview

(source: EIA)

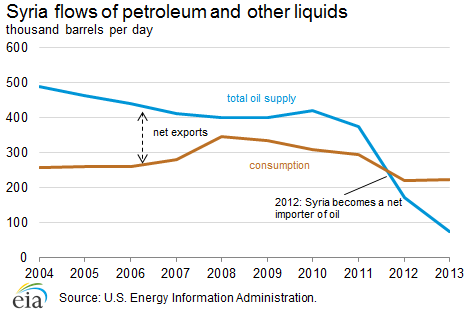

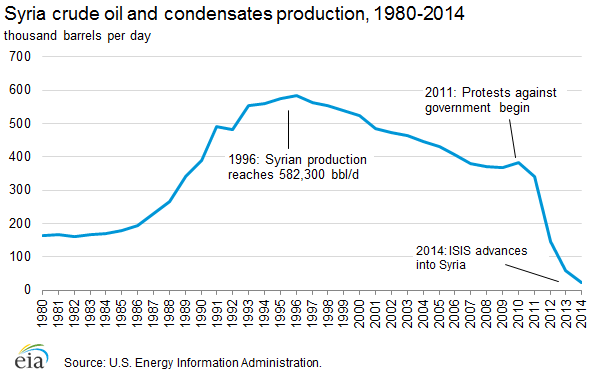

Syria's energy sector is in turmoil because of the ongoing civil conflict that began in the spring of 2011, with oil and natural gas production declining dramatically since then.

Syria's energy sector has encountered a number of challenges as a result of conflict and subsequent sanctions imposed by the United States and the European Union. Damage to energy infrastructure—including oil and natural gas pipelines and electricity transmission networks—hindered the exploration, development, production, and transport of the country's energy resources.

Syria, previously the eastern Mediterranean's leading oil and natural gas producer, has seen its production fall to a fraction of pre-conflict levels. Syria is no longer able to export oil, and as a result, government revenues from the energy sector have fallen significantly. Prior to the current conflict, when Syria produced 383,000 barrels per day (b/d) of oil and 316 million cubic feet per day (Mmcf/d) of natural gas, Syria's oil and gas sector accounted for approximately one fourth of government revenues.

Syria faces major challenges in supplying fuel oil to its citizens. Electricity service in much of the country is sporadic as a result of fighting between government, opposition forces and the Islamic State of Iraq and Syria (ISIS). Further, the exploration and development of the country's oil and natural gas resources have been delayed indefinitely. Nevertheless, even if the fighting were to subside, it would take years for the Syrian domestic energy system to return to pre-conflict operating status.

| Oil | |||

| Proved reserves, 2015 (million barrels) | Petroleum and other liquids supply, 2014 (thousand b/d) | Petroleum and other liquids consumption, 2013 (thousand b/d) | |

| 2,500 | 33 | 224 | |

| Natural gas | |||

| Proved reserves, 2015 (billion cubic feet) | Dry natural gas production, 2013 (billion cubic feet) | Dry natural gas consumption, 2013 (billion cubic feet) | |

| 8,500 | 187 | 200 | |

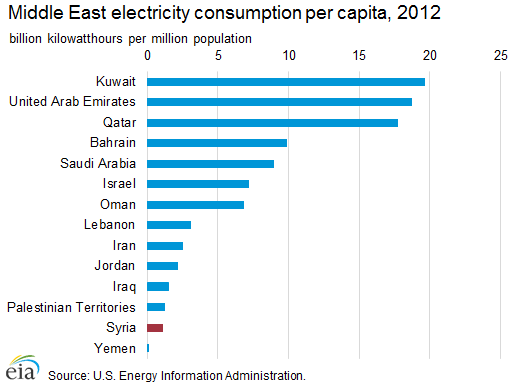

| Electricity | |||

| Generating capacity, 2012 (gigawatts) | Electricity generation, 2012 (billion kilowatthours) | Electricity consumption, 2012 (billion kilowatthours) | |

| 8.9 | 29.5 | 25.7 | |

| Source: U.S. Energy Information Administration, Oil & Gas Journal | |||

Sector organization

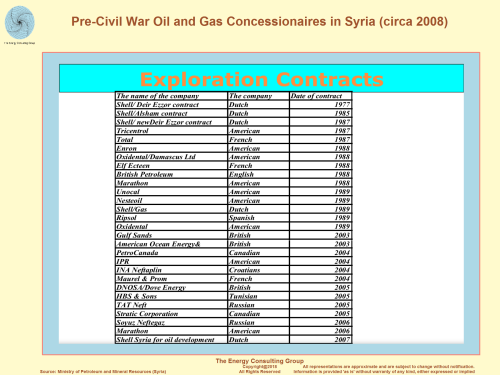

In 1964, Syria passed legislation that limited licenses for exploration and investment to the Syrian government. The Ministry of Petroleum and Mineral Resources oversees the Syrian oil and natural gas sectors, and is in charge of setting policy priorities and coordinating the efforts of the state-led companies that operate in the sector. The following information reflects the pre-conflict operating status of Syria's oil and natural gas sector.

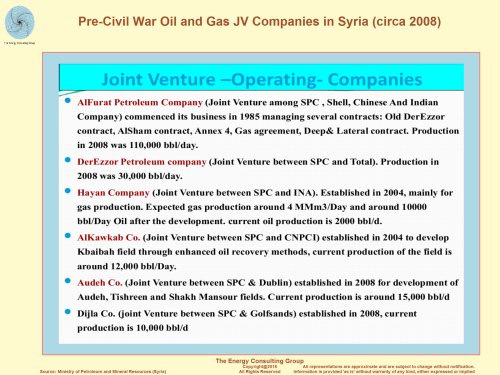

The General Petroleum Company (GPC) oversaw the strategies for exploration, development, and investment in Syria's oil and gas sector, and supervised the activities of its many affiliated companies, including the Syrian Petroleum Company (SPC) and the Syrian Gas Company (SGC). The SPC was Syria's largest state-owned oil company, and it had a number of production-sharing agreements (PSAs) in place throughout the oil sector. Most of the country's PSAs were split equally between the SPC and its partners. These arrangements often ensured that the Syrian government retained a certain percentage of the oil produced in its fields as royalties. Contracts regularly lasted up to 25 years.

The SPC operated through several subsidiaries, the most notable being the Al-Furat Petroleum Company (AFPC), which was a joint venture between the SPC, Royal Dutch Shell, the Chinese National Petroleum Company (CNPC), and India's Oil and Natural Gas Corporation (ONGC). Other SPC subsidiaries included the Deir Ez-zor Petroleum Company, the Syria-Sino Alkawkab Oil Company, the Hayan Petroleum Company, the Oudeh Petroleum Company, and the Dijla Petroleum Company. International oil companies with interests in Syria prior to the conflict included Gulfsands, Sinopec, and Total, as well as several other smaller companies. By most accounts, nearly all of Syria's foreign partners have left the country.

The General Organization for Refining and Distribution of Petroleum Products (GORDPP) managed the country's downstream portfolio for oil and natural gas. It also oversaw the operations of the Banias Refinery Company and the Homs Refinery Company, among other duties. Other important state entities overseen by the GORDPP included the Syrian Company for Oil Transport (SCOT, which operated the country's pipelines), Mahrukat (which dealt with refined products), and Sytrol (the state marketer of petroleum products).

The Syrian Gas Company (SGC)—which fell under the GPC—was the key entity in Syria's upstream natural gas operations, a position it inherited after being split off from the SPC in 2003. Syria's natural gas distribution network was managed by the SCOT. The majority of Syria's gas-processing plants were operated by state-owned firms—led by the SPC—but there were a handful that were operated by international companies.

The Ministry of Electricity oversaw the electricity sector in Syria, while the General Establishment for Electricity Transmission operated the country's transmission system. Syria also had separate entities for the generation and distribution of electricity.

Petroleum and other liquids

Syria's oil sector has been in a state of disarray since 2011. Production and exports of crude oil have fallen to nearly zero, and the country is facing supply shortages of refined products.

The Oil & Gas Journal estimated Syria's proved reserves of oil at 2.5 billion barrels as of January 1, 2015, a total larger than each of Syria's neighbors except for Iraq.1 Most of Syria's crude oil is heavy (low gravity) and sour (high sulfur content), which requires a specific configuration of refineries to process. Sanctions placed on Syria by the European Union in particular—whose countries accounted for the majority of Syrian oil exports previously—limited the number of markets available to import and process the heavier Syrian crudes. The loss of oil export capabilities severely limited Syrian government revenues, particularly the lost access to European markets, which in 2011 imported over $3 billion worth of oil from Syria, according to the European Commission.2 Prior to sanctions, European refineries were the target market for Syrian oil because they were configured to process heavy, sour oil.

Since the swift advance of ISIS in 2014, Syrian oil production has essentially ceased. The lack of domestic crude oil production has caused the country's two main refineries to operate at less than half of normal capacity, resulting in supply shortages for refined petroleum products. Further, sanctions—and the resulting loss of oil export revenues—make importing petroleum products difficult. It is likely that Iran continues to supply Syria with crude oil and refined products.3 Oil theft is also a problem, with Syrian officials claiming that hundreds of barrels of crude oil are being stolen and shipped to neighboring countries each day.

Exploration and production

Syria's oil production, which averaged over 400,000 b/d between 2008 and 2010, was less than 25,000 b/d in May 2015.

With the onset of sanctions by the United States, the European Union, and other countries, almost all of the international oil companies (IOCs) and national oil companies (NOCs) ceased operations in Syria, significantly limiting Syria's exploration and production capabilities. Most of Syria's existing oil fields are located in the east near the border with Iraq or in the center of the country, east of the city of Homs. Possession of Syria's largest producing fields including the Deir-ez-Zour region—which includes Syria's largest field, Omar—has fallen to ISIS.4 The exact level of current production from these fields is unknown, but U.S.-led airstrikes have certainly caused structural damage in the region and have limited its output.

Syria's average oil production from 2008—10 was stable at approximately 400,000 b/d, but since the combined disruptions of military conflict and economic sanctions began, the country's production dropped dramatically. The latest U.S. Energy Information Administration (EIA) estimates indicate that Syrian crude oil and condensates production has fallen to barely 25,000 b/d—including production outside the control of the Syrian government. This level is a drop of roughly 90% since the conflict began in March 2011.

The years prior to the onset of hostilities saw an increased emphasis on the use of enhanced oil recovery (EOR) techniques in Syria, with several companies promising increased investment in the country's mature oil fields. The AFPC utilized water- and gas-injection systems to aid recovery in many of its fields, and—with little in the way of new discoveries expected—EOR techniques are likely to become increasingly important for ensuring stable output should production resume.

Syria also has shale oil resources, with estimates of reserves in 2010 ranging as high as 50 billion tons according to Syrian government sources.5 The Syrian government delayed a bidding round for the country's shale resources—scheduled for November 2011—because of the political situation in the country.

Imports and exports

Syria's crude oil exports are assumed to have ceased, and the country is having difficulties importing refined petroleum products.

In the years leading up to 2011, Syria began importing more refined petroleum products to meet rising domestic demand. In 2010, the country imported an average of 105,000 b/d of refined petroleum products, and exported just 36,000 b/d. At the time, Syria was also exporting more than 150,000 b/d of crude oil, but the country's crude exports are now effectively zero. Following the imposition of sanctions and the advancement of ISIS, Syria has experienced a shortage of crude oil and petroleum products. Iran continues to supply Syria with approximately 60,000 b/d of crude oil, but this level is still insufficient to meet demand.6

Syria has three export terminals on the Mediterranean Sea, all operated by the Syrian Company for Oil Transport (SCOT) under the GORDPP. Syria has two crude oil export blends, Syrian Light and Syrian Heavy (also known as Souedieh).

Refining and consumption

The combined capacity of Syria's two refineries has fallen to roughly half its pre-conflict output.

Syria has two state-owned refineries, one in Homs and the other in Banias. The combined nameplate capacity of the two refineries at the beginning of 2015 was slightly less than 240,000 b/d according to the Oil & Gas Journal;7 a total capacity that met only three-fourths of Syria's pre-conflict demand for refined products. With damage to pipelines and other infrastructure around the refinery at Homs in particular, Syrian officials claim that the country's actual refining capacity now is closer to 50% of its pre-war nameplate capacity.8 Several proposed refineries are now on hold or canceled altogether, such as the proposed 100,000 bbl/d facility at Abu Khashab backed by the CNPC, which was canceled because of the security situation in the country.

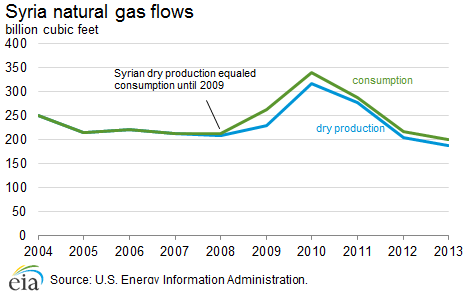

Natural gas

Syria's natural gas sector has not been affected quite as severely by the ongoing conflict as its oil sector, although dry natural gas production is down by at least 40% compared with pre—conflict totals.

The Oil & Gas Journal reported that Syria held proved reserves of 8.5 trillion cubic feet (Tcf) of natural gas as of January 2015. Like the country's oil fields, the majority of Syria's natural gas fields are in the central and eastern parts of the country. Most of Syria's natural gas is used by commercial and residential customers and in power generation. Syria also uses its natural gas in oil—recovery efforts, with approximately 20% of daily gross production reinjected into the country's oil fields between 2004 and 2013.

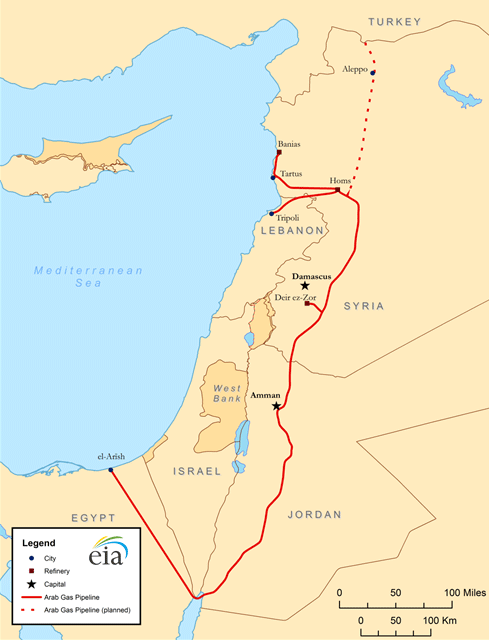

In 2008, Syria became a net importer of natural gas, but the country's current state of conflict—and sanctions—have affected the ability of Syria to receive natural gas. The only source of natural gas imports, the Arab Gas Pipeline, became the target of attacks as the conflict intensified, forcing the pipeline to shut down. Syria's plans to convert all existing thermal power generation facilities to natural gas—fired plants (many are currently using refined petroleum products) hinge on these import volumes being available, but this goal seems out of reach.

Exploration and production

Syria's dry natural gas production fell to less than 200 billion cubic feet (Bcf) in 2013 according to estimates from EIA.

In 2010, the last year under normal operating conditions, Syria produced 316 billion cubic feet (Bcf) of dry natural gas. By 2012, that figure dropped by 28% to about 227 Bcf, and EIA estimates that production was 187 Bcf in 2013. Prior to the current conflict, more than half of Syria's natural gas production came from nonassociated fields, with those volumes being redirected to oil fields and domestic demand centers through the country's domestic pipeline network. In 2012, 25% of Syrian natural gas production was reinjected into the country's oil fields to aid in oil recovery, a slight increase from the 2002—11 average of nearly 19%. According to Syrian government officials, in 2013 more than 90% of the country's natural gas production was used by the country's power sector.

Imports and exports

According to press reports, Syria is not currently importing natural gas from Egypt via the Arab Gas Pipeline.

Syria has never produced sufficient volumes of natural gas to export. Prior to the recent conflict, Syria imported a small amount of natural gas from Egypt to supplement its own domestic production, but production volumes dropped by more than 60% between 2010 and 2011 (from 24.4 Bcf to 8.8 Bcf, according to Cedigaz data) and stopped in 2012. Those imports came via the Arab Gas Pipeline, which started operating in 2008 and sends Egyptian gas into Syria (near Homs) via Jordan. There were plans to expand the pipeline into Turkey, Lebanon, and eventually to Europe, but developments are now unlikely.

Electricity

Syria's electricity infrastructure, including power plants, substations, and transmission lines, has been a frequent target of sabotage.

In 2010, Syria generated almost 44 billion kilowatthours of electricity, 94% of which came from conventional thermal power plants. The remaining 6% came from hydroelectric power plants. Refined petroleum products and natural gas fuel Syria's thermal generating facilities. Syria plans to convert all of its thermal generation facilities to run on natural gas as soon as possible, although this is unlikely until hostilities end. Syria's lack of domestic refining capacity, the ongoing sanctions on the country's energy sector, and declining natural gas production combine to limit the availability of the necessary fuel for Syria's electric plants and have contributed to blackouts in many parts of the country.

By early 2013, more than 30 of Syria's power stations were inactive, and at least 40% of the country's high voltage lines had been attacked, according to Syria's Minister of Electricity. Syria's electricity generating capacity was 8.9 gigawatts in 2012, although damage to electricity generating facilities, high voltage power lines, and other infrastructure has likely reduced the country's effective capacity. Electricity distribution losses, already 17% of total generation in 2012, have likely climbed even further.

Prior to the current conflict, the Syrian government hoped to emphasize the importance of renewable energy and laid out plans to develop renewable energy sources in the country. The 11th Five-Year Plan for 2011—2015 made that goal clear; however, there will be no progress in the near term.

Syria, along with Egypt, Iraq, Jordan, Libya, Lebanon, the Palestinian Territories, and Turkey, is a member of the Eight Country Interconnection Project, but the current state of Syria's electricity sector leaves the future of the project—within Syria—in doubt. In 2012, Syria reduced its imports of electricity from neighboring Egypt, Jordan, and Turkey, opting to pursue an arrangement with Iran instead. That agreement would connect 250 megawatts of transmission capacity from Iran to Syria, and came after the announcement that Syria had suspended purchasing electricity from Turkey. Iran agreed to provide Syria with a $1 billion credit facility in mid-2013, with half of the total earmarked for electric power projects.9

In September 2012, Syria's Minister of Electricity announced plans to boost generating capacity by an additional 1.5 gigawatts over the next several years. However, as with most projects in the country, current conflict and lack of access to international capital makes such an undertaking impossible.

Notes

- Data presented in the text are the most recent available as of June 24, 2015.

- Data are EIA estimates unless otherwise noted.

Sources

2European Commission, Trade in goods with Syria, April 2015, page 5.

3Middle East Economic Survey, “Damascus Cash Crunch as Crude Below 10,000 b/d”, volume 58, issue 18 (May 1, 2015).

4Middle East Economic Survey, “Syria's Economic Woes Only Set to Intensify”, volume 58, issue 5 (January 30, 2015).

5International Business Times, “Syrian Oil and Gas: Little-known Facts on Syria's Energy Resources and Russia's Help”, September 4, 2013.

6Middle East Economic Survey, “Syria's Economic Hardships Intensify with Fuel Shortage”, volume 58, issue 9 (February 27, 2015).

7Oil & Gas Journal, Worldwide Refining Survey, January 1, 2015.

8Middle East Economic Survey, “Damascus Cash Crunch as Crude Below 10,000 b/d”, volume 58, issue 18 (May 1, 2015).

9Reuters, “Iran grants Syria $3.6 billion credit facility to buy oil products”, July 31, 2013.